What is CFD trading and how does it work?

Discover everything you need to know about CFDs and learn how to trade a range of asset classes — including forex, commodities, indices, and cryptocurrencies — using this versatile derivative product.

Start trading today. Call +971 (0) 4 5592108 or email support@bestwingglobal.com. Our sales team is available from 8:00AM to 5:00PM (GMT+4), Monday to Friday.

What’s on this page?

- 1.What is CFD trading?

- 2.3 CFD trading essentials

- 3.Is CFD trading right for me?

What is CFD trading?

CFD trading involves speculating on the price movements of an underlying asset — such as forex, commodities, indices, or cryptocurrencies — without owning the asset itself. A CFD, or contract for difference, is a type of derivative that allows you to trade on a platform like ours and take advantage of both rising and falling markets.

With CFD trading, you don’t take ownership of the underlying asset — instead, you gain exposure to its price fluctuations. This enables you to speculate on whether the price will rise or fall.

We offer a wide range of CFD markets for you to trade, including indices, forex, cryptocurrencies, commodities, and more.

Some of the key characteristics of CFDs and CFD trading are explained in more detail below.

What is CFD trading?

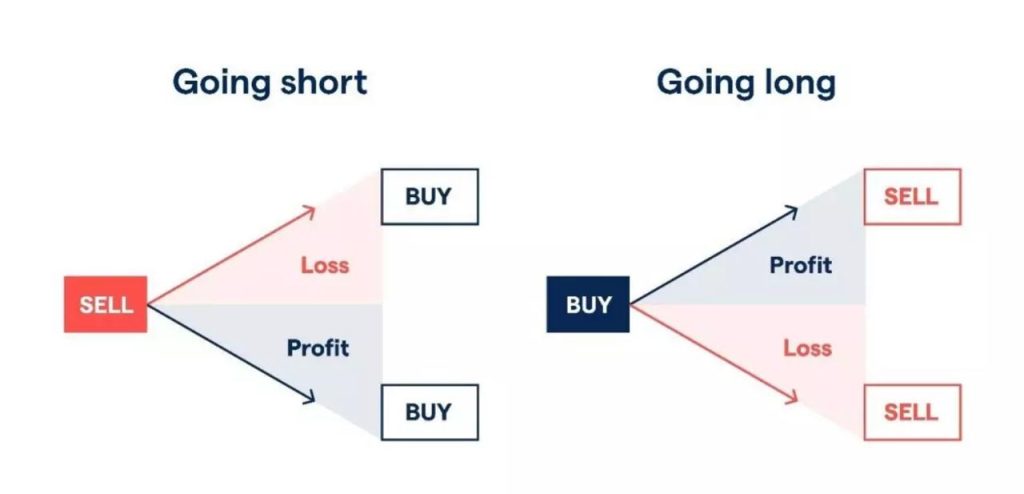

You can go long or short with CFDs

When trading CFDs, you’re speculating on whether an asset’s price will rise or fall. If you expect the price to increase, you’ll buy (go long); if you expect it to decrease, you’ll sell (go short). Your profit or loss depends on whether the market moves in the direction you predicted. It’s important to understand that both buying and selling carry risk, and losses can occur on either side of the trade.

Before opening a position, make sure you fully understand how CFDs work and take steps to manage your risk effectively. On our platform, opening a position is simple: select ‘buy’ on the deal ticket to go long, or ‘sell’ to go short.

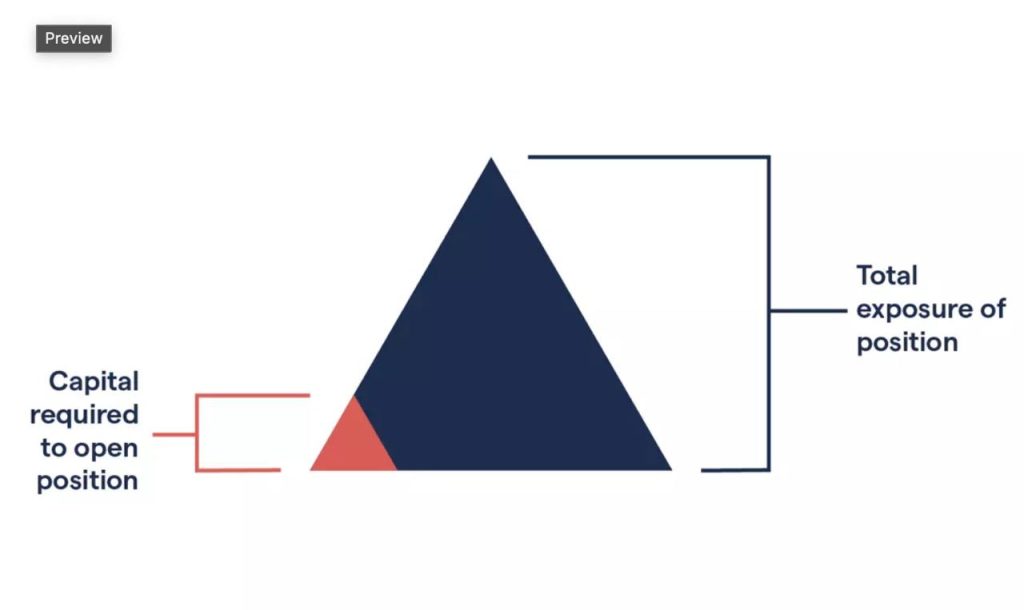

CFD trading is leveraged

Leverage in CFD trading allows you to gain full market exposure with a relatively small upfront deposit, called margin. This means you only need to commit a percentage of the total trade value to open a position — making your capital go further.

However, while leverage can amplify profits, it also increases the potential for losses, as both are calculated based on the total value of the position, not just the margin you put down.

For example (Forex):

You want to open a CFD position on EUR/USD, trading one standard lot (100,000 units). If the EUR/USD rate is 1.1000, the full value of the position is $110,000. With a 3.33% margin requirement, you’d only need $3,663 to open the trade. However, any profit or loss will be calculated on the full $110,000 exposure — not just your margin.

For example (Crypto):

Suppose you want to open a CFD position on 1 BTC, with the market price at $30,000. If the margin requirement is 20%, you’d need to deposit just $6,000 to control that position. But remember — your profit or loss will be based on the full $30,000, not the $6,000 margin.

You’ll open a leveraged position with margin

CFD margin requirements can vary depending on the market you’re looking to trade – not all asset classes will have the same margin rate.

For example, we require a deposit equal to 20% of the total position size on major cryptocurrencies like Bitcoin or Ethereum. That means to open a CFD position worth $10,000 on Bitcoin, you’d only need to deposit $2,000 as margin.

Learn more about our CFD margin rates

CFDs behave similarly to their underlying market

CFD trading is designed to closely mirror the performance of the underlying markets. Our CFD prices move in line with the underlying asset’s price, ensuring transparency and consistency. Depending on the market you’re trading, costs will vary — some assets include a spread within the price, while others may incur a commission.

Is CFD trading right for me?

CFD trading might be suitable for you if you’re looking to speculate on both rising and falling markets, and if you’re comfortable trading with margin. However, it’s important to understand that CFDs are leveraged products, and losses can exceed your initial deposit.

If you’d rather buy and own financial assets outright, stock trading may be a better fit.

To support your journey, we offer a free demo account for risk-free practice, as well as access to BWG Academy – our comprehensive education platform for traders of all levels.

Why do people trade CFDs?

- Leverage: CFDs let you trade with a small deposit while gaining full market exposure.

- Flexibility: Trade rising or falling markets by going long or short with CFDs.

- Longer hours: Trade select markets after hours, though prices may differ from regular sessions.

- Hedging: Offset potential losses by balancing them with gains from other positions.

5 steps to becoming a CFD trader

Find out how CFDs work

CFDs work by mimicking the

underlying market. So, while you can mimic a traditional trade that profits as a market rises in price, you

can also open a CFD position that will profit as the underlying market decreases in price.

Say, for example, that you

buy 5 contracts when the asset buy price is 7500. A single contract is equal to a $10 per point, so for each

point of upward movement you’d make $50 and for each point of downward movement you would lose $50 (5

contracts multiplied by $10).

As always, possible profits

and losses will be magnified because these will be based on the full 7500 position, not the margin amount.

If you sell when the asset is trading at 7505, your profit would be $250

$250 = (5 x 10) x (7505 – 7500)

If you sell when the asset is trading at 7497, your loss would be $150

-150 = (5 x 10) x (7497.0 – 7500.0)

Note that these profits and

losses exclude costs and charges. These could be overnight funding charges,

commission or guaranteed stop fees.

Learn how CFD profit and loss works

To calculate your profit or loss on a CFD trade, multiply the number of contracts by the value of each contract, then multiply that by the difference between the opening and closing prices of the trade.

Find out how to place a CFD trade

Once you’ve chosen a market, you’re ready to place a trade. If you expect the asset’s value to rise, you’d ‘buy’ (go long); if you expect it to fall, you’d ‘sell’ (go short).

You can track all open positions directly on the trading platform. To exit a trade, simply click ‘close’. If you opened by buying, you’d close by selling the same number of contracts at the current sell price – and vice versa.

Learn about CFD timeframes

With CFDs, you can trade either the spot market or CFD futures, depending on which market you’re looking to take a position in.

- Spot trading (also known as cash trading) is best for shorter-term trading, as the spot price is the immediate real-time price of the asset. We charge an overnight funding fee for spot positions that are kept open until the next day

- CFD futures (also known as forwards) are best for medium- to longer-term trades, as they enable you to speculate on the price that underlying asset will be on a specific date. We don’t charge overnight funding on CFD futures – making it a popular choice for those who plan to keep positions open longer than a day or two

Know the costs when trading CFDs

Usually, the cost to open a CFD position is included in the spread, which means the buy and sell prices are adjusted to reflect trading costs.

However, this doesn’t apply to share and ETF CFDs. For these, prices mirror the underlying market, and the cost is charged via commission instead. This brings the experience of trading share CFDs closer to traditional share dealing.

If you hold a daily CFD position past the daily cut-off time (typically 10pm UK time, though this varies by market), you’ll also incur an overnight funding charge. This covers the cost of maintaining a leveraged position over time.

Learn more about the costs of trading CFDs on shares and ETFs, indices, cryptos, commodities, and forex.

Free CFD trading courses and resources

Becoming a successful CFD trader requires skill, knowledge, and consistent practice. To support you on your journey, we provide free resources through BWG Academy, including trading courses and webinars.

You can also practise risk-free using a free demo account with virtual funds to build your confidence.

Whether you’re just starting out or have years of experience, you’ll also find helpful strategy guides and market newstailored to all levels.

FAQs

What does CFD mean?

A CFD (Contract for Difference) is a type of derivative that lets you speculate on the price movements of financial markets without owning the underlying asset. This means you can potentially profit from both rising and falling prices by going long (buy) or short (sell).

Want to dive deeper? Learn more about CFD trading.

How can I get started trading CFDs?

Start by exploring CFD trading through BWG Academy or by using our demo account to practise in a risk-free environment. Once you’re confident and understand the risks, you can open and fund a live account, select your preferred market, and analyse the asset thoroughly. When you’re ready, simply choose your position size and apply your risk management strategy.

Learn how to start trading CFDs.

How do BWG and other CFD providers make money?

We primarily earn through the spread, which is the difference between the buy (offer) and sell (bid) prices we quote. This spread is wrapped around the underlying market price, meaning you’ll typically buy slightly above and sell slightly below the real market value.

For share CFDs, the pricing works a bit differently. Unlike many providers, we don’t widen the spread — instead, we charge a small commission when you open and close a trade.

We don’t profit from client losses. Our business model focuses on offering a transparent and fair trading environment.

Learn more about our charges and how we make money.

How do I use CFDs for hedging?

You can use CFDs to hedge your existing positions by opening a trade that profits if your other investment loses value. For example, if you own an asset, you might open a short CFD position on a related market. If the asset’s price drops, the loss in value could be offset by gains from your CFD position.

Learn more about using CFDs for hedging in our guide.

What is the difference between CFDs and futures?

When trading CFDs, you buy contracts if you expect a market to rise or sell if you expect it to fall. Your profit or loss reflects the change in the market price, and you can close your position anytime while the market is open.

Futures, on the other hand, are standardized contracts to trade an asset at a set price on a future date. They often involve physical delivery and must be traded on an exchange. Futures pricing factors in both current market movements and expectations of future value.

With us, you can speculate on futures prices through CFDs, without needing to own the actual futures contract.

Does a CFD expire?

CFD positions typically don’t have an expiry date, meaning you can keep them open for as long as you choose. However, certain markets – such as futures, forwards, and options – do come with expiry dates. For spot positions, if held past 10pm UK time, an overnight funding fee will apply.

Try these next

CFDs vs stock trading

Discover the ins and outs of CFD trading vs investing

CFD calculator

Find out what your margin, profit and loss might be when trading CFDs

Platforms and apps

Explore browser-based desktop trading and native apps for all devices